Howdy! And welcome to the second dispatch of the AdExchanger Commerce Newsletter.

I’m James Hercher, a voracious eater of snacks, purchaser of goods, our commerce beat reporter and, thus, a qualified guide as we explore the intersecting worlds of retail and data-driven marketing.

This week, we dive into Shopify, and its potential as a uniquely positioned purchase data supplier to the advertising industry with a product called Shopify Audiences.

Shopify is the ecommerce and payment processing tech for the longtail of ecommerce merchants, and owns a shopping app called Shop that collects behavioral data about online shoppers. With the first-party app data and merchant network, Shopify process online credit card transactions in North America at a scale rivaled only by Apple, Amazon and Walmart.

Here to shop

In November 2021, Shopify’s market cap surpassed $200 billion. But the rollout of Apple’s AppTrackingTransparency framework and an economic downturn have had their impact. Shopify closed Tuesday worth $52 billion.

Shopify’s base of small merchants and sellers, many of which are social-based or online-only companies, were hit hard by ATT, which made them unable to effectively target ads to potential new customers.

But Shopify Audiences is one way to potentially turn those sour apples into lemonade.

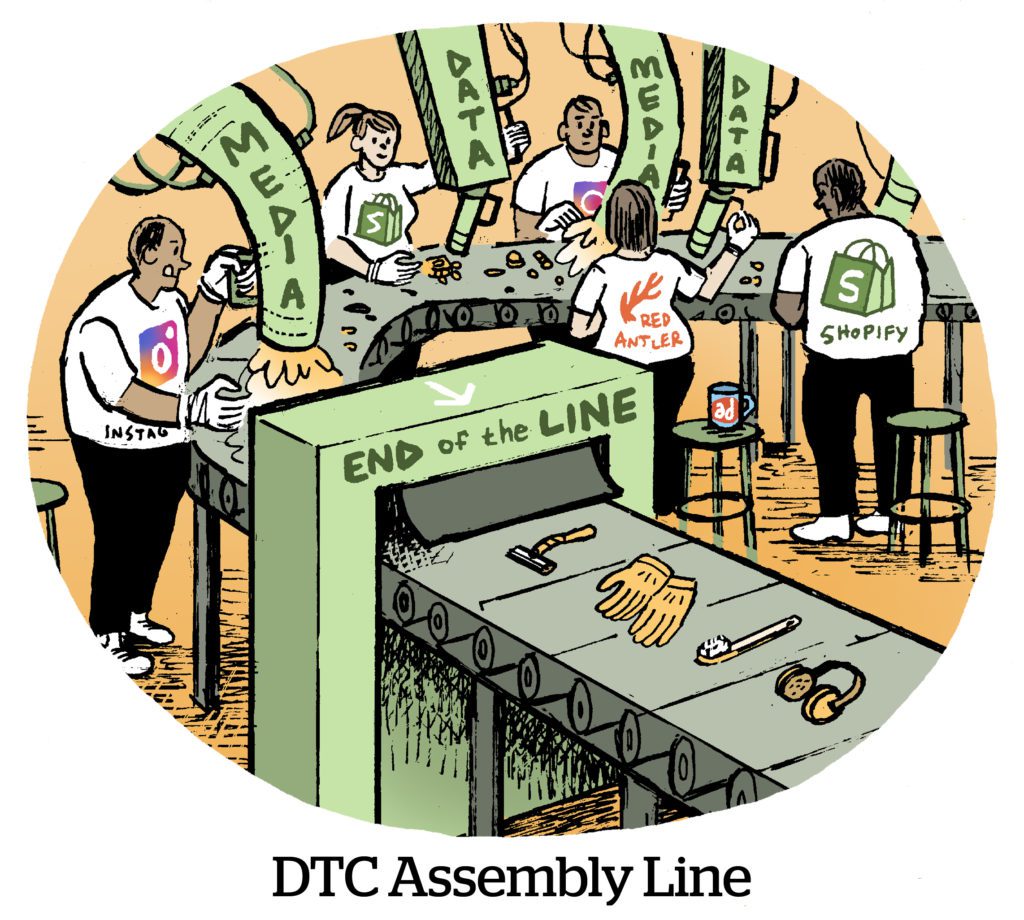

Last year, Shopify introduced Audiences as a way for merchants to upload first-party data to Shopify and create lookalike audience lists. The big two – Facebook and Instagram and the Google fleet – were the only two channels with Audiences partnerships in 2022. Pinterest was added in January.

Audiences Schmaudiences

For now, these three walled gardens are the only partners for Shopify Audiences. The product isn’t yet a major revenue driver, and Shopify is wary of becoming an ad data player.

For instance, Shopify doesn’t take a cut of ad budgets with Audiences. Instead, those campaigns lead to Shopify payment processing, and Shopify gets a low single-digit percent of the sale.

Considering the crazy-high CPMs that retail ad networks charge for ad inventory attributed to store sales, Shopify is likely forsaking serious moolah.

Three Shopify merchants and two Shopify ad-buying specialists told AdExchanger that the Audiences product doesn’t scale right now or provide much in the way of useful analytics.

The data is put through two black boxes – Shopify’s layer of audience segmentation and then the walled garden optimization machine – so there’s not much to see aside from the ad platform’s reported ROAS improvement.

But Shopify Audiences represent a big change for the company. It’s gone from facilitating ad platform integrations within the Shopify UI to creating audience segments from across Shopify’s merchant network – which many insiders hope is a sign that Shopify will lean further into data-driven advertising services.

Shopped out

Historically, though, Shopify has been hands-off when it comes to advertising.

At Amazon, the atomic unit is the customer. Amazon has no qualms forcing brands to bid for potential Amazon customers.

Shopify’s atomic unit is the merchant. A person shopping at DTCsunglasses.com is the merchant’s customer, not Shopify’s. Shopify Audiences is such a big step because it pools data to create leads for one merchant from another merchant’s traffic.

The challenge of embracing advertising is twofold for Shopify. It could risk losing its objectivity in terms of which platforms perform best and lose its position as a pure merchant-facing SaaS business, said Bill Michels, GM of Moloco’s retail media business and former EVP of product at The Trade Desk.

But Audiences is a product Shopify can credibly sell as equally available and beneficial to any of the merchants in its base.

“The merchant is the customer for (Audiences),” Michels said.

When Shopify President Harley Finkelstein touted Audiences on the company’s earnings call last week, for example, he didn’t mention Shopify’s prowess. Instead, he called out Maison MRKT, a marketing services partner, that he said helped a fashion seller halve its cost per acquisition.

If Shopify really gets into advertising, it would be yet another platform where sellers must pay to play – and that’s a heel turn the company is loath to make.

Walled gardens FTW (again)

If Shopify is leaving money on the table, who are the ones to gain?

Walled gardens, mainly.

Google, Meta and Pinterest already have Audiences integrations, and Shopify Audiences will likely extend to Snapchat, TikTok and Twitter, which have partnerships to connect merchant accounts to their ad platforms.

Last week, Eric Seufert of Mobile Dev Memo made a case for Shopify to open Audiences to more retailers and ad platforms.

Facebookagram, Google, TikTok, Snapchat, Pinterest, et al. have tried to become one-click shopping and purchase platforms in their own right. None have succeeded. They can only stare in envy at Amazon Advertising humming along on purchase data.

Fact is, walled garden platforms were nearly sent back to ancient Egyptian times by Apple’s ATT. But Shopify could be their Rosetta Stone.

And Meta and Google in particular must be thrilled by Shopify staying in its lane and not launching an ad engine of its own.

So, what happens next?

For now, the programmatic industry is waiting, watching – and, perversely, hoping for Shopify’s shares to tank. Any crisis of profitability is an opening for ads. (Just ask Netflix, Uber, Instacart and even Zoom).

But programmatic platforms must demonstrate they can meet privacy and brand suitability concerns, Michels said, whereas walled garden media, including long-tail inventory like the Google Display Network, often gets a pass.

Not to mention that ecommerce sellers use Meta and Google for bottom-of-the-funnel targeting, Michels said. If programmatic web ads don’t lead to near-direct sales, Shopify Audiences can’t work its magic.

“But as [Shopify] looks at the open internet as a place to send spend,” he said, “we’d love to be part of showing that it can deliver.”