“Uncovering Earth’s Secrets: A Journey Into Its Deepest Hole”

That’s the title of a made-for-arbitrage (MFA) article about a failed Soviet-era scientific expedition to drill a hole tens of thousands of feet into the Earth’s crust.

But it could easily double as a headline for the latest ad tech exposé.

The story referenced above appears on “historicalgenius.com,” an MFA site operated by monetization provider Content IQ. (Content IQ is owned by publicly traded ad tech holding company Perion, parent to Undertone, CodeFuel, Vidazoo and Hivestack.)

But the article also appears word for word and with the exact same images (and tons of ad slots, of course) on “recommended.spin.com,” a subdomain associated with premium music publisher SPIN – yet, weirdly, hosted by Content IQ.

So … what gives?

Another SPIN on MFA

Well-known, legitimate publishers, including SPIN, The Jerusalem Post, International Business Times and Benzinga, currently or very recently partnered with third-party vendors that generate programmatic ad revenue from paid traffic via Facebook ads. The resold subdomains are jammed with recycled MFA articles produced by notorious content farms.

Put more bluntly: These publishers traded on the good reputation of their long-standing top-level domains – which have been live since the 1990s – to make money on the Q.T. off trashy content they didn’t write.

Sincera, a startup that gathers and supplies metadata to the ad tech ecosystem, observed this practice while helping The Trade Desk investigate traffic anomalies across examples of multiple domains owned by the same publisher.

Digging in, Sincera detected strange behavior among several URLs using domain prefixes affiliated with top publishers. These subdomains were created by the publishers and set to receive traffic from servers operated by third parties.

One of these third parties is Perion-owned Content IQ, and the other is Samyo News, a “media company” owned by Cortex Media Group, which is itself owned by a public Israeli software company called Viewbix. Content IQ and Cortex directly manage all paid traffic acquisition and arbitrage that happens on these subdomains.

It’s like an MFA easy button.

“The publisher sets up the domain, points it to their servers – and that’s pretty much it,” said Sincera Co-Founder Mike O’Sullivan. “Then they just wait for the checks to arrive.”

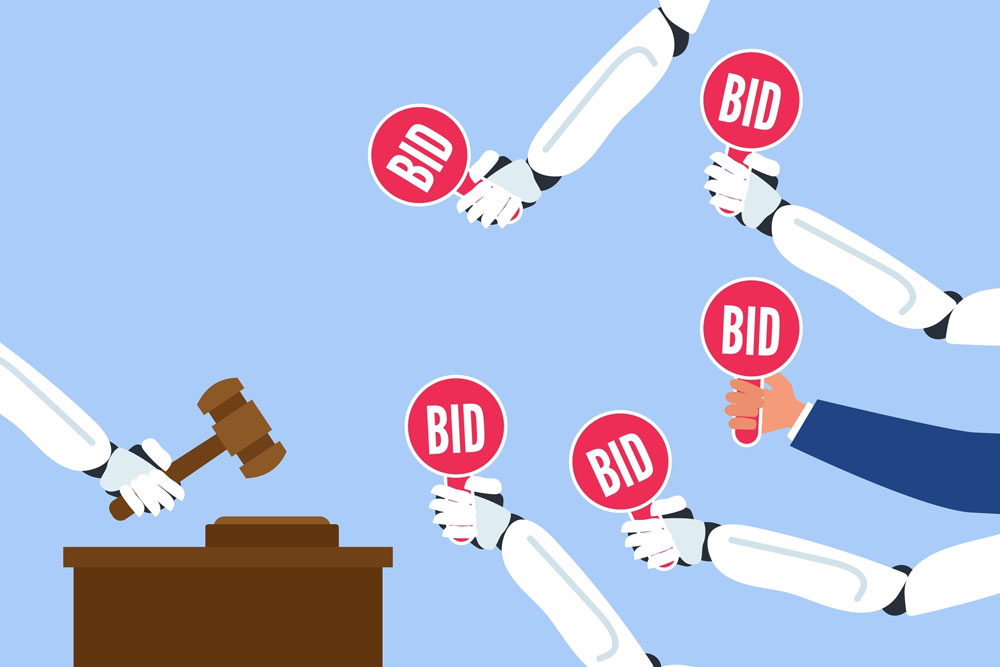

And all the usual ad tech suspects are there, too, which isn’t surprising. Because DSPs and SSPs typically take their cues from top-level domains rather than subdomains, they may mistakenly label resold MFA subdomains as quality inventory.

But be that as it may, Content IQ and Cortex list these ad tech companies as so-called “partners” on their websites (for anyone doing due diligence).

Between them, the code on magazine.jpost.com and recommended.spin.com is littered with bidders, including Vidazoo, Undertone, Criteo, Media.net, Minute Media, OpenX, Rubicon (now Magnite), Connatix, PubMatic, AppNexus (now Xandr), TripleLift, Sovrn, Index Exchange, Sharethrough, Smart AdServer (now Equativ), 33Across, Yieldmo and Google. (And that’s not even everyone.)

So, what does all this look like?

Whereas spin.com or jpost.com, for example, feature the high-quality music and news content one would expect to find there – as well as a normal ad load – the subdomains monetized by Content IQ and Cortex Media Group (recommended.spin.com, feeds.spin.com and magazine.jpost.com) contain your garden variety ad-ridden MFA mélange.

For SPIN, Content IQ cribbed random articles to populate these subdomains directly from its so-called portfolio of media brands, including Historical Genius, Boredom Therapy and Pets Fanatic. Cortex does the same for The Jerusalem Post from its crop of equally crummy sites, including Herald Weekly, Daily-Stuff and Daily-Choices.

Both Content IQ and Cortex maintain unaffiliated Facebook pages that pour money into Facebook ads to drive visits to the subdomains, which generate virtually zero organic traffic.

So … kind of like what Forbes was up to last month before getting exposed by Adalytics, right?

Well, not exactly.

Not an isolated issue

What’s happening here is different than the Forbes situation – and perhaps even more cynical.

Yes, Forbes surreptitiously ran an MFA subdomain and spoofed the URL to bypass DSP and SSP audits. Buyers and their partners were rightfully pissed.

But at least Forbes was repurposing its own content for the slideshows and cluttered clickbait on www3.forbes.com.

By contrast, all the articles running on the resold subdomains discovered by Sincera are republished MFA posts pulled from other low-quality sources that have no association with the legit publisher whatsoever.

“Yes, you could say it’s just arbitrage,” O’Sullivan said. “But one of the main reasons it works is because of the years and years of trust associated with the primary site. They’re banking on the fact people will see this URL, recognize it and think it’s OK.”

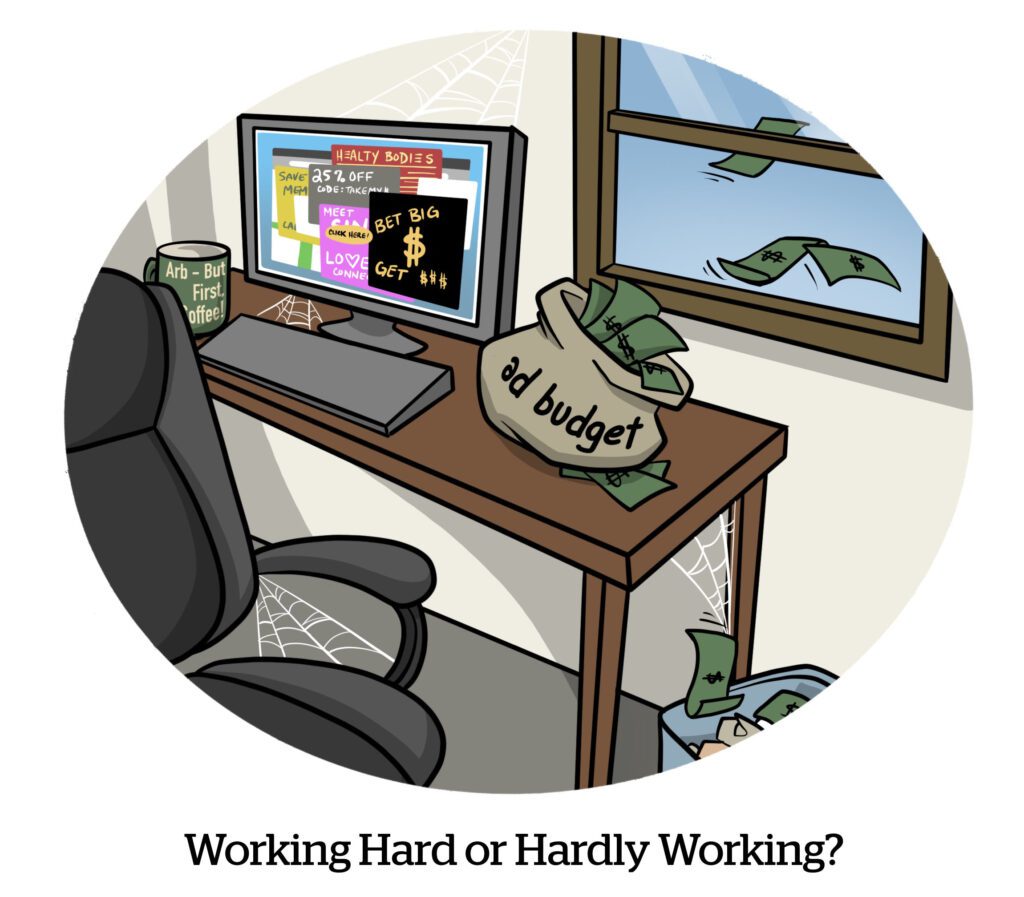

The ad experience on a resold MFA subdomain is sloppy and aggressive, with a heavy ad load and frequent refreshing. The content is both subpar and confusing.

Take this Spanish-language article, for example: “Conmovedoras fotos del funeral de la reina Isabel que pasarán a la historia” (which translates to “Moving photos from Queen Elizabeth’s funeral that will go down in history”).

Facebook ads purchased by Weird Little Tales, a page operated by Content IQ, directed people to this article on recommended.spin.com. Once there, the SPIN logo is clearly displayed in the top left corner, implying that this site is, in fact, part of spin.com.

But that’s where the connection to the real spin.com ends.

The article itself (which was pulled from Mental Flare, yet another site operated by Content IQ) displays every MFA hallmark, including an overuse of images and a high ad-to-content ratio. It takes more than a minute of active scrolling to even get to the bottom of the page except, whoops – there is no bottom.

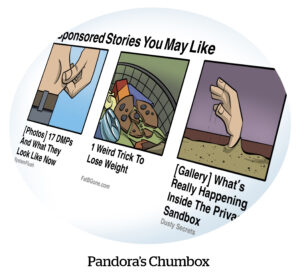

The page is an infinite scroll of MFA and chum.

Strap in while you scroll, because this is a wild ride: At the purported end of the article, first there’s an Outbrain widget stuffed with “You May Also Like” sponsored links, followed by another Spanish-language article packed with photos from the 1930s (for some reason). Following another Outbrain widget is a Spanish-language article about a man who “comes up with an ingenious plan to stop people from mowing his garden” (whatever that means), then you scroll past yet another Outbrain widget and hit another Spanish-language article about how “the Mötley Crüe boys were crazy in the 1980s … and these photos prove it” – which is, to be fair, actually somewhat related to music.

But that was probably just an accident.

“If you go to spin.com, it’s full of great music content,” said Sincera Co-Founder Ian Meyers. “If you go to one of the subdomains, you can see them actively monetizing unrelated Spanish-language articles from Facebook with so many ads on the page that some of them aren’t even able to load – and that’s just one example.”

A SPIN spokesperson told AdExchanger the publisher has now “terminated our relationship with Content IQ and are in the process of shutting down subdomains they operated.” SPIN did not share what triggered this “process” or when it began.

The International Business Times and Benzinga – neither of which responded to a request for comment – were actively outsourcing their subdomains to third parties for ad arbitrage until just shortly after the Forbes scandal broke in April.

And going a little back in time, based on Sincera’s observations, Newsweek, USA Today, Dailymotion, Parade, PopSugar and Refinery29 maintained active resold MFA subdomains on and off at different points between 2020 and the end of 2023. Although these subdomains have since been disabled, some are only dormant, not dead – meaning the infrastructure is still in place if those publishers choose to rev up the third-party arbitrage machine once again.

A Newsweek spokesperson told AdExchanger it had “a limited relationship” with Content IQ between 2020 and 2022, and during that time “a small amount of traffic was sent to Newsweek and was clearly classified as ‘paid’ traffic’ as part of our regular TAG disclosure and auditing process.”

None of this is a great look.

Here’s a question, though (and the devil’s advocate is asking): Can you fault online publishers for trying to make some money? It’s cold out there with layoffs, brand safety challenges and unsympathetic private equity owners often at the helm.

But exploiting the cachet of a reputable domain while secretly partaking in revenue generated from MFA isn’t a sustainable strategy in the long term.

For one, there are tools on the market to spot MFA and expose this behavior. Sincera recently built one to weed out resold MFA subdomains on a pre-bid basis, which The Trade Desk plans on using.

Even so, there’s little incentive for publishers to stop capitalizing on resold clickbait.

“More scrutiny is a positive thing, but as long as this type of arbitrage is perceived as lucrative, it’ll continue,” Meyers said, and then paused. He had a developer console window open to demonstrate the outlandishly heavy ad load on recommended.spin.com, which clocked in at more than 3,000 ad requests on a single page in less than 60 seconds.

“I’ve got to say,” Meyers said after a moment, “my computer is running pretty warm right now.”

Perion declined to comment for this story. Cortex Media Group, The Jerusalem Post, International Business Times and Benzinga did not respond to a request for comment.